The IRS also charges interest on overdue taxes. These fees will accrue until your balance is paid in full or the penalty reaches 25% of your tax, whichever comes first. If you do file on time, but you can't pay what you owe in full by the due date, you'll be charged an additional 0.5% of the amount of the tax not paid on time for each month or part of a month you are late.

The IRS assesses another penalty for a failure to pay your taxes owed. If you don't file your return, you may have to pay an additional 5% of the unpaid tax you were required to report for each month your tax return is late, up to five months. Stop late filing and payment penalties and interestįiling a tax return on time is important to avoid or minimize penalties, even if you can't pay the balance you owe.

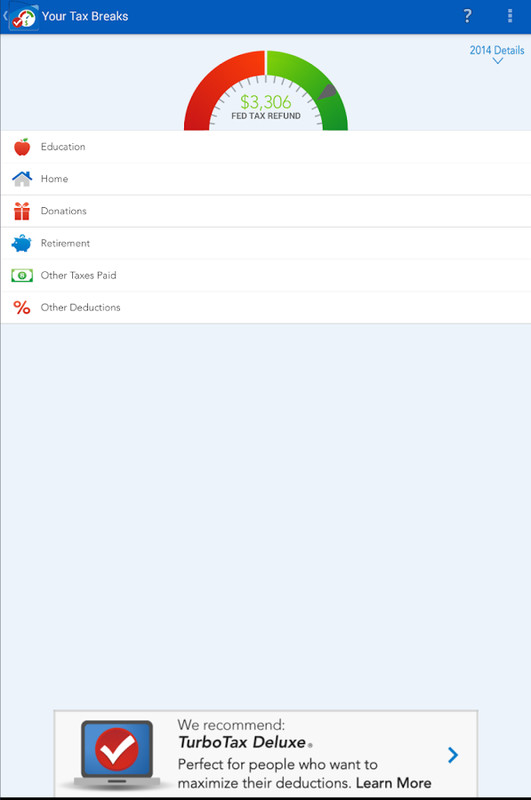

In these cases, filing a tax return could result in a tax refund that puts money in your bank account.Ģ. While many have federal income taxes withheld from their paychecks, sometimes too much money is withheld. One practical reason to file a back tax return is to see if the IRS owes you a tax refund. Why you should file back taxesįiling back tax returns could help you do one or more of the following: Learn more about why one may choose to file back taxes and how to start this process. Should you file back taxes? It may not be too late to file a previous year's tax return to pay what you owe or claim your refund. Having tax returns for past years can also help with loan applications.

If you qualified for federal tax credits or refunds in the past but didn't file tax returns, you may be able to collect the money by filing back taxes.

You can file back taxes for any past year, but the IRS usually considers you in good standing if you have filed the last six years of tax returns.

0 kommentar(er)

0 kommentar(er)